It’s common knowledge that savings accounts are currently offering low interest rates. With inflation at 3.7% in July and savings interest rates at major banks hovering around 1.5%, the value of your money is eroding. It’s time to put that money to work, but how? What’s the best choice for a saver who wants returns without losing sleep at night? In this blog post, we’ll discuss the following topics:

- Why invest your money?

- Two popular investment categories: Shares versus Real Estate Investing

- BRXS notes: Real estate investing made accessible for everyone

Why invest your money?

Saving

Investing your savings allows your money to work for you. However, it’s crucial to only invest money you can afford to lose. Financial advisors often recommend maintaining enough savings to cover four to five months of living expenses in case of emergencies. This buffer provides financial security, allowing you to invest the remaining savings for the long term.

Investing

To achieve a positive real return on savings, the interest rate must exceed inflation. As mentioned, the inflation rate for July 2024 was 3.7%, compared to a savings interest rate of approximately 1.5% at major banks. Therefore, investing money you can afford to lose can be a good option. Once you’ve decided to invest, the first step is to determine where to invest, also known as ‘asset allocation’. There are several options (asset classes), including shares, bonds, and real estate. Each asset class has its own advantages and disadvantages, such as liquidity (how easily the money can be accessed), volatility (whether the values fluctuate significantly or remain stable), and entry barriers (shares or bonds can be purchased with a few hundred euros, while real estate often requires a substantial investment). The next question is your desired return, also known as the ‘return requirement’.

The general rule of thumb with investing is that risk and return go hand in hand: the higher the return, the higher the risk, and vice versa. This allows investors to find a risk/return ratio they’re comfortable with.

The data

Historical data reveals significant differences between the results of money kept in savings accounts and money invested. Below is an overview from ING Investment Office assuming EUR 100,000 is invested with a sustainable strategy and the corresponding risk profiles (from very defensive to very offensive).

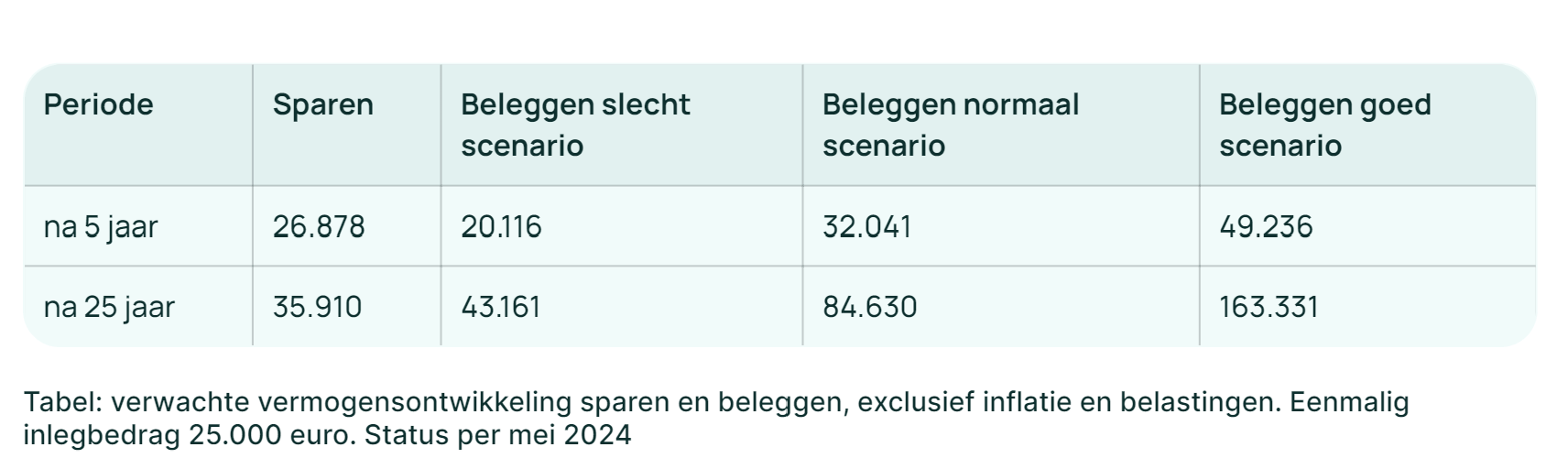

This shows that EUR 100,000 with a ‘very offensive’ profile would have grown to over EUR 260,000 after 10 years. In the overview from Finner, an investment management comparison website, the differences between saving and investing are clearly visible. Below are options calculated for periods of 5 years and 25 years: (1) saving, (2) a poor scenario with investing, (3) a normal scenario with investing, and (4) a good scenario with investing.

Even in a poor scenario, investing can yield significantly higher returns than saving. However, it’s important to have a long-term perspective. As you can see, after a period of 5 years, a poor scenario results in a loss of approximately EUR 5,000. It’s crucial that you don’t need to sell during this period. Doing so could lead to unrest.

These examples consider investments in shares. Besides shares, there are other asset classes, such as bonds and real estate. To provide a clear picture of two well-known and popular investment categories, shares and real estate, we’ll further outline the differences and risks of both.

Two popular investment categories: Shares versus Real Estate Investing

Shares

Investing in shares

Investing in shares means buying pieces of a company, making the investor a partial owner of that company and thus entitled to a share of the profits. When these profits are distributed, they are called dividends. The more shares owned, the more dividend the investor receives. If the market, for example, expects the company’s future profits to grow, more investors will want to buy this share, and its value will increase. When the share is then sold, the investor has made a profit.

Risks

There is the option to buy individual shares, where the investor acquires partial ownership of each company. It’s also possible to buy a basket of multiple companies, where the investor invests in, for example, 500 companies simultaneously. This diversification reduces the specific risk of each company and spreads it across these 500 companies, for instance, within the same sector or country. When opting for this, there are often multiple risk profiles (as mentioned in the ING example above):

- Defensive;

- Neutral;

- Offensive.

The more risk taken, the higher the potential return. The risks involved include market risk, meaning that the economy or sector in which the investment is made performs poorly, causing share values to decline, and interest rate risk, meaning that prices can fall when general interest rates rise. The more prices fluctuate, the higher the ‘volatility’. The stock market is generally quite volatile. This can cause unrest, as the value of the portfolio can suddenly drop significantly. Investors need to be able to cope with this and not require the money at that specific moment.

Real estate

Real estate investing

By investing in real estate, an investor can, for example, purchase a property and rent it out to someone who will live there. Besides residential real estate, investors can also choose to invest in commercial real estate, such as shops, offices, or business premises. Just like with shares, real estate investing carries risks.

Risks

Buying and renting out a property may seem simple, but there’s a lot involved. For instance, investors must comply with various government regulations, the property may require maintenance, and vacancies can occur when tenants terminate their contracts. Additionally, real estate often requires a higher initial investment, making entry into this asset class challenging. Once the investment threshold is reached, portfolio diversification is often low, as, for example, only one apartment is purchased, concentrating all the risk.

Shares versus Real estate

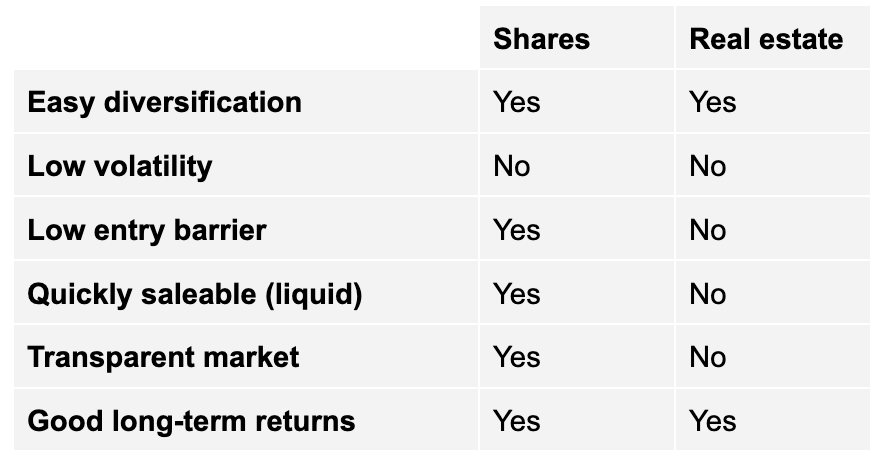

Below is an overview of the advantages and disadvantages of shares and real estate for you as an investor:

With the significant housing shortage in the Netherlands, there is enormous demand for both rental and owner-occupied properties, creating ample opportunities for real estate investment. However, the high entry barrier makes it difficult for many investors to participate. For example, the average house price is EUR 432,000, making it inaccessible for many investors. BRXS offers a solution.

BRXS notes: Real estate investing made accessible for everyone

BRXS notes

BRXS enables investors to invest in real estate properties that we buy and manage from as little as €100 via BRXS notes. This allows individuals to build a diversified portfolio without having to actively engage in purchasing, managing, renting, and more. BRXS’s professional real estate team analyses, acquires, and manages the properties, eliminating the need for expertise and time from the investor to benefit from the opportunities in the Dutch real estate market. BRXS only selects properties intended for rental or already rented out upon purchase.

Security

By investing in BRXS notes, you receive an annual fixed interest rate on these notes, which are backed by Dutch rental properties in cities like The Hague, Arnhem, and Amsterdam. As a noteholder, you have a security right on the real estate in which your notes are held. In the highly unlikely event that we are permanently unable to meet our interest payment obligations, the Stichting Zekerheden (Security Foundation) can, on behalf of the noteholders, force the sale of the property. If the value of the property is then higher than or equal to the purchase price, the investor will receive their investment back.

Why BRXS notes?

If security, peace of mind, and stability are important to you as an investor, BRXS notes could be a good option. With the fixed return, you are not subject to the volatility of the stock market but receive interest payments quarterly into your account. Because BRXS pays this interest at a fixed rate, you don’t feel the impact if, for example, a tenant fails to pay or maintenance costs are slightly higher. The BRXS team has calculated this in advance and manages it professionally, taking away this risk for the investor.

Diversification

The golden rule of investing is: diversify, diversify, diversify. By diversifying as an investor, you can mitigate the risk of a portfolio. For example, when determining which asset classes to invest in, a good first step could be to invest a portion of the total amount in BRXS notes and the other portion in the stock market (e.g., the MSCI World, a fund that tracks the global economy). If the shares in the portfolio experience a decline in value, the BRXS notes can mitigate the risk by paying a fixed interest rate. If the stock market performs well, you can benefit from both the increase in the value of the shares and the fixed interest from the BRXS notes.